Customers’ business

habits

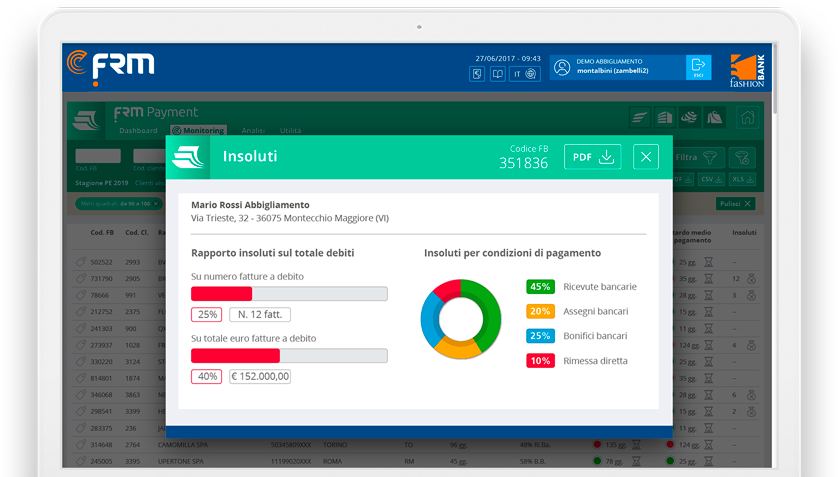

Informs you about your customers’ payment methods, conditions and times, about delays and outstanding payments in the Fashion market distribution.

The Central Risks

FRM Payment guides you in the decision-making process on your customers’ wallet’s credit. Identify bad payers, monitor risk trends and the financial exposure of your distribution. It allows you to prevent and quantify any losses due to insolvencies.

The platform

Through an IT platform fed with data shared, anonymously, by companies belonging to the same market segment, it informs you about the conditions and commercial habits of your customers and of potential new ones.

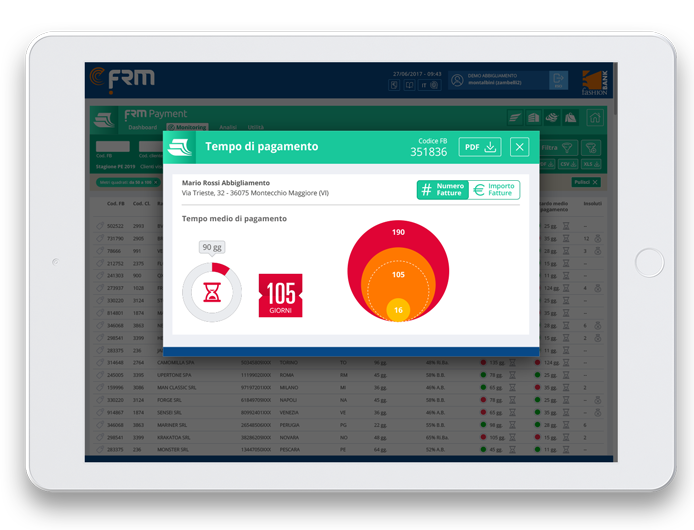

Payment times, terms and conditions

For each name, a detailed report is drawn up which highlights: payment terms (30-60-90…days), conditions (bank receipts, transfers, checks…) actual payment times, delays, and outstanding payments (as a percentage of the total and number of invoices).

Revenue trend

The collected data are continuously integrated with the specialized Fashion Bank database (Financial risk) and offer the opportunity to statistically analyse the entire customers portfolio (trend of collections, average delays, unpaid percentage…) and to examine or compare different years and seasons.

Interface and API

FRM Payment has an interface that easily adapts to any type of management system and can communicate directly with it to manage the shipping phases in case of criticality. There is a ‘’notification’’ service that will warn of the variation of any of the parameters set.

FRM – Fashion Risk Monitoring is a unique online portal that allows Fashion players to access monitoring services specialized in the financial and commercial analysis of wholesale markets.

For years FRM services have been the most valid tool for prevention of insolvencies and for the correct management of trade receivables in the Fashion market.